Senior Resident Magistrate Court sitting in Blantyre, on Monday, reserved its ruling to Tuesday, May 25, on a bail application by lawyers representing five Mapeto David Whitehead and Sons (DWSM) limited officials who are being accused of committing various offences bordering on tax evasion.

The suspects are Director Faizal Gaffar, Managing Director Mohamad Gaffar, Financial Controller Abdul Rashid Bakali, Procurement Manager Yasmeen Muhammad and General Manager Martin Chapansi.

They are accused of defrauding the government of revenue amounting to K10.8 billion.

In his submission, one of the defence lawyers Jai Bnda told the court that all the suspects are Malawian nationals, have families in the country and they run a big company hence cannot default bail conditions.

He further said the company has come to a stand-still following their custody and there are fears that hundreds of workers employed at the company might not access their salaries for the month of May if the suspects remain in custody.

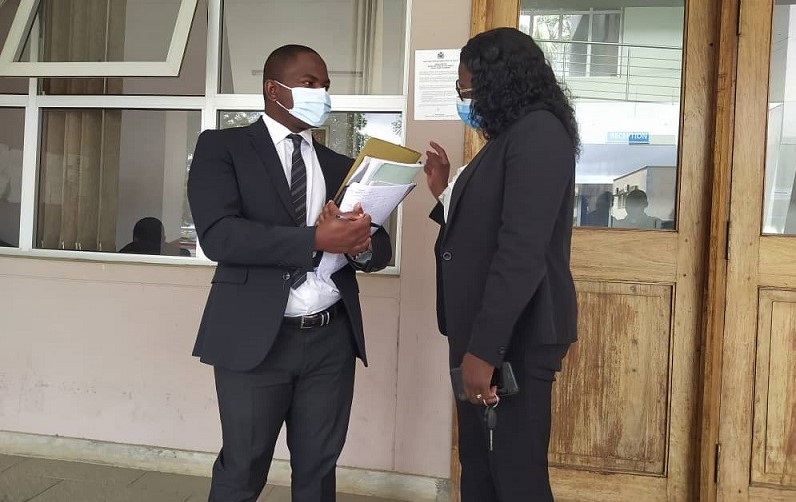

But in his argument, state lawyer Anthony Mwangwela, described the defence affidavit as too premature.

Mwangela said: “Our main argument is that the application for bail was brought prematurely because the state is still within the 48 hour period which we are supposed to bring all the accused persons before the court and we are still in the process of complying with those obligations.”

Senior Resident Magistrate Akiya Mwanyongo, said the case is a serious one and he needs to carefully look into all the submissions from both the defence and the state sides before giving his ruling on the matter.

He also agreed with the state that it should be accorded time to finish cautioning the suspects.

Mwanyongo, therefore reserved his ruling to Tuesday, May 25 from 3pm.

The four mangers were arrested on Friday while the fifth accused, Faizal Gaffar, presented himself to Malawi Revenue Authorities (MRA) in Blantyre on Sunday, in company of his lawyer Jai Banda, where he was also arrested.

According to MRA head of corporate affairs, their investigation has established three cases of alleged tax evasion.

The cases are related to under-declaration of sales, customs duty evasion and that the company was employing expatriates and paying them appropriately but was declaring less to MRA in terms of income tax or pay as you earn (PAYE).